#

Overview

#

What is farswap?

farswap is a decentralized exchange platform with integrated liquidity aggregator built on NEAR blockchain.

#

Just another DEX? Not we're better:

There is a key thing to know about farswap:

farswap implements the new

Combined swap can

- reduce price slippage

- reduce fees

- provide a very fast trading experience

#

Combined Swap

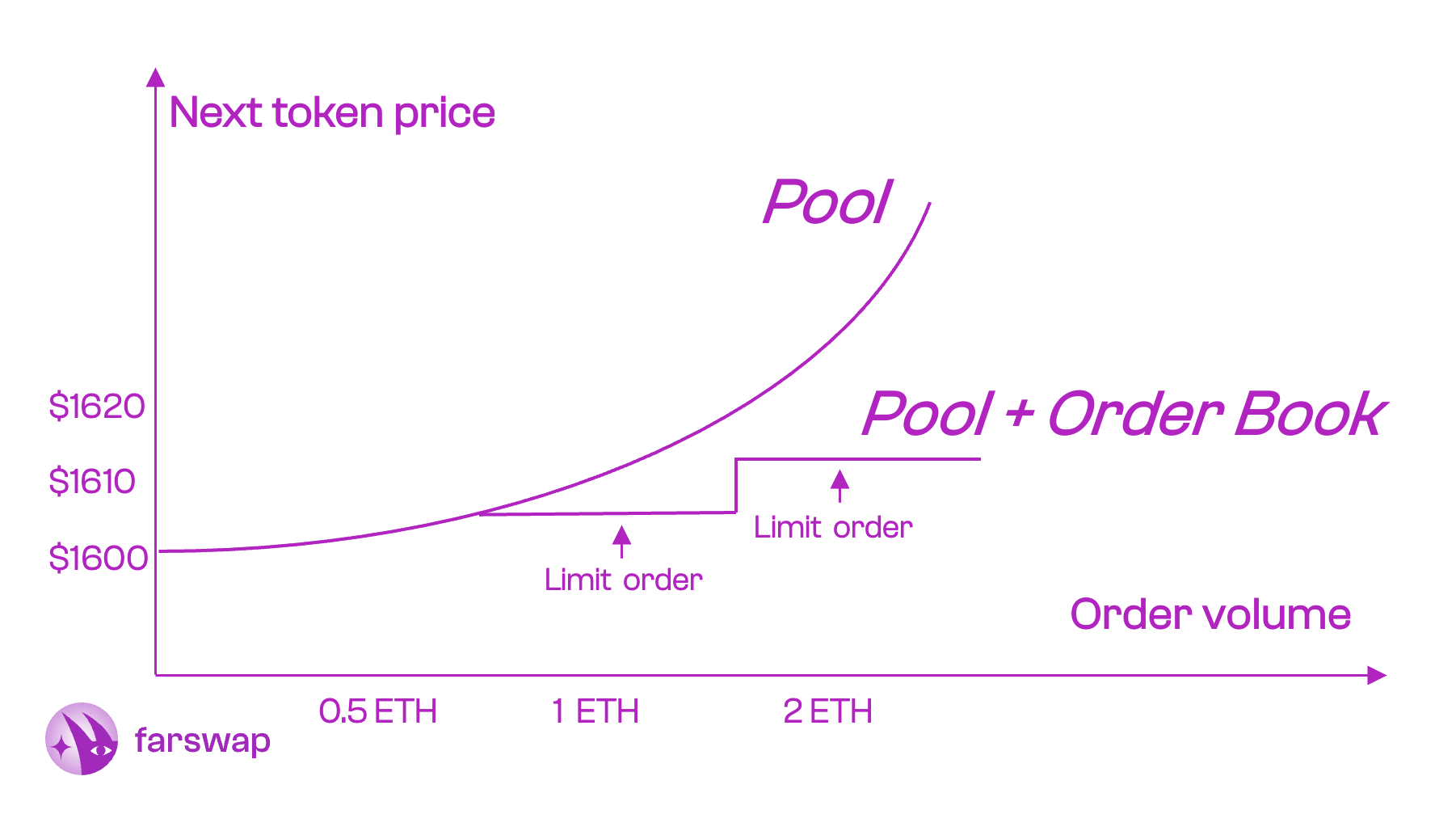

Combined swap can be imagined as order-books working on top of liquidity pools

#

Why it works?

farswap order books, built on top of pools, make illiquid pairs liquid by concentrating way more liquidity around the market price. Consequently, trades become more profitable as order books reduce the slippage and the fees. Combined swap is very fast, since we use mathematical models instead of computing values on the blockchain.

Combined swap is better than just a liquidity-pool-based exchange, as we have an additional liquidity in farswap order books, well concentrated around the market price. Also, Combined swap is better than just an order book, since we can use the liquidity of the existing pools along with the liquidity in farswap order books to provide better prices.

example:

#

Implementation

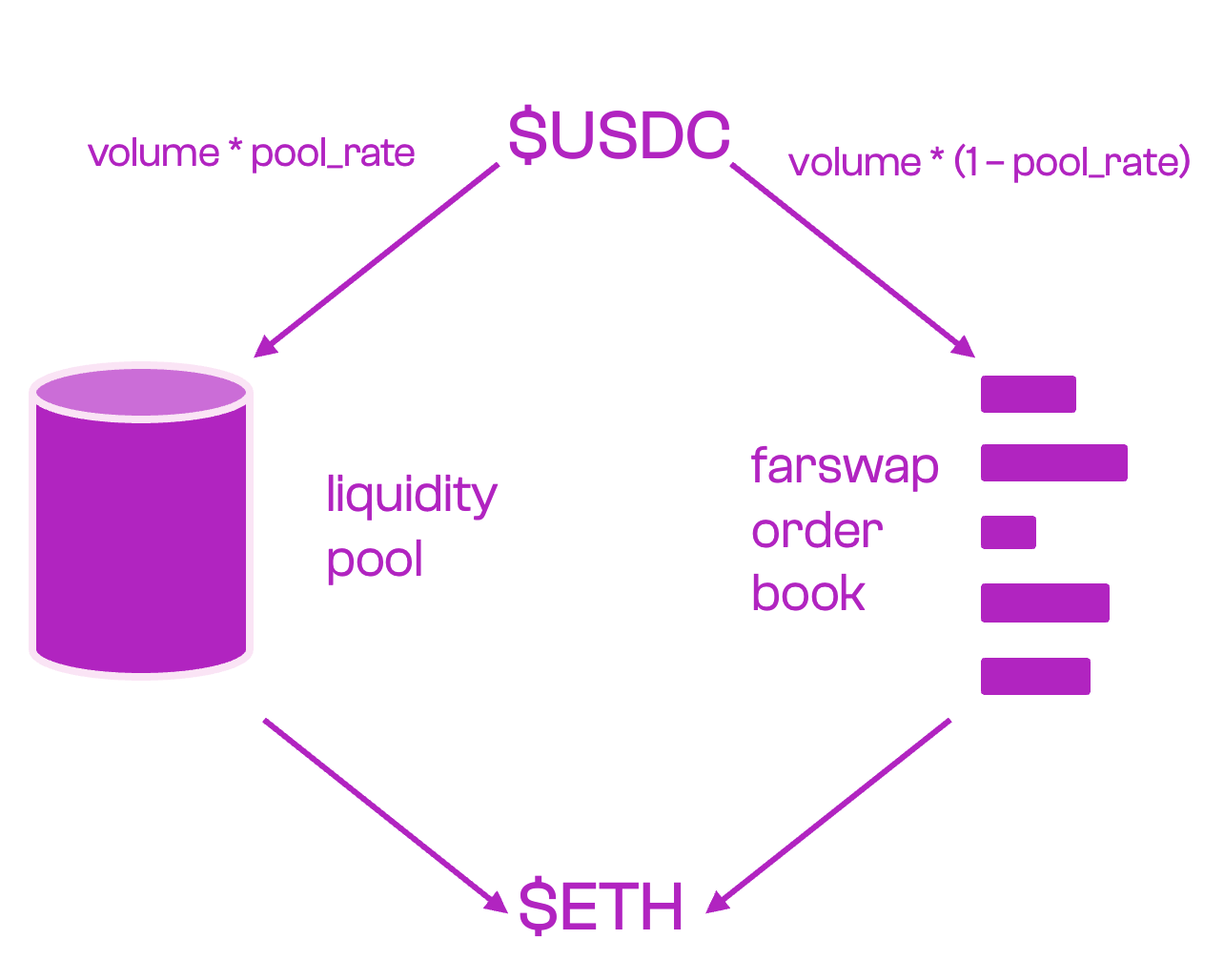

When swapping, one part of assets is being swapped in the order book and another is in liquidity pool.

#

Pool rate

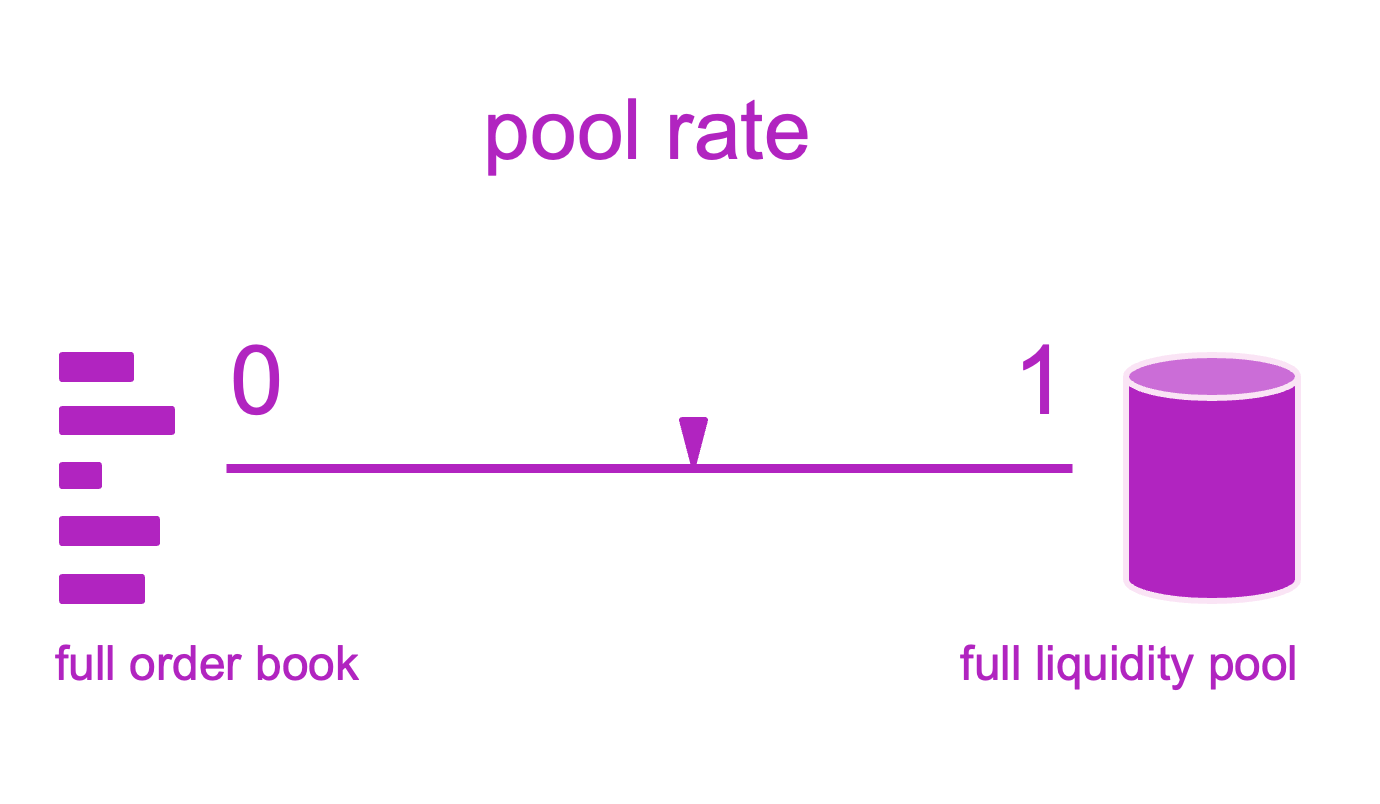

Which part of tokens is swapped in pool? It is always different. In next paragraphs we will call it "pool rate".

pool_rate = volume_to_swap_in_pool / total_volume_of_swap

It depends on the total number of assets presented for the pair in both liquidity pool and order book. In order to choose the best pool rate, we will use a predictive models based on our researches.

#

Why do we need it?

Most DEX platforms use two models of exchange: automated market maker (AMM) and order book. Both models have some disadvantages

- Illiquid market makes traders have difficulty in finding matching orders due to large bid-ask spread and low trading volumes. If you want to have successful orders, you have to make sure that your highest bid is lower than the lowest ask.

- AMM causes high slippage for large orders: Slippage relies on the liquidity pool’s size of a certain trading pair. The liquidity pool needs to be 100x greater than the size of the order to keep the slippage rate under 1%

These problems cause a liquidity lack on the market. At farswap we believe that with the combined swap, even shitcoins will be liquid.